Source: AFP

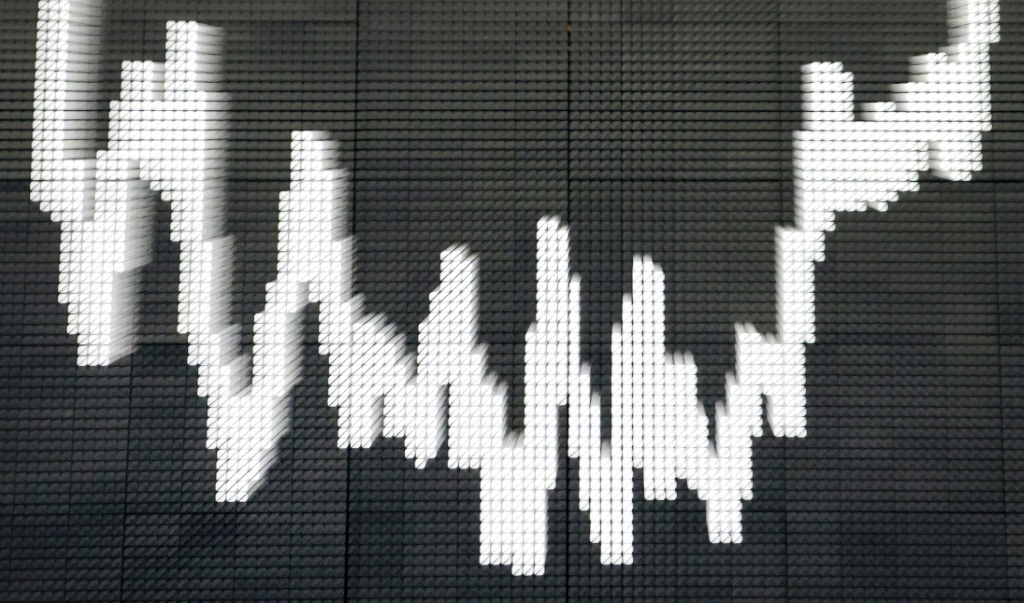

Asian markets were mixed on Tuesday as investors jittery awaited the Federal Reserve’s policy decision and the release of US inflation data, while the euro struggled to recover from a sell-off fueled by political uncertainty in Europe.

After an upbeat run last week fueled by signs of easing in the labor market and economy, Friday’s forecast-busting nonfarm payrolls report provided a dose of reality that interest rates may remain high for some time.

Speculation is swirling about how many, if any, cuts the Fed will introduce this year, with several officials warning they are reluctant to move too soon for fear of a rebound in inflation, which remains stubbornly above target.

The focus is now on Wednesday’s conclusion of the latest policy meeting and the release of May’s consumer price index, which fell in April after three consecutive readings above forecasts.

Read also

Asian markets fall as strong US jobs data dampens hopes of a rate cut

While policymakers are expected to keep borrowing costs on hold, the main interest is their so-called “dot plot” forecast for these coming months.

Traders started the year predicting as many as six cuts, but have since scaled back and now the most optimistic estimate is three, with some even looking at zero.

“The interest rate guessing game continues,” Morgan Stanley’s Chris Larkin told E*Trade. “Even the most inflation-friendly numbers likely won’t prompt the Fed to act before September.”

All three major indexes on Wall Street rose on Monday, with the S&P 500 and Nasdaq once again setting records.

However, Asian investors were less confident on Tuesday, after a tepid performance the previous day in holiday-weakened trade.

Hong Kong, Shanghai and Sydney dipped on their return from an extended weekend break, while Singapore, Manila and Jakarta were also down.

Read also

The US Fed is likely to remain on hold, reversing interest rate cut expectations

However, Tokyo, Seoul, Wellington and Taipei moved on.

The euro remained under pressure against its peers amid rising political uncertainty after French President Emmanuel Macron called early parliamentary elections in response to a strong showing by the country’s far-right in EU elections.

The move followed a crushing blow to centrists in the polls, with hardliners in Spain, Germany, the Netherlands, Italy and Austria also performing well.

Oil fell after Monday’s rally that came as traders awaited the release of an OPEC report outlining its demand forecasts.

The gains followed a recent plunge in commodities sparked by OPEC and other producers announcing they would begin reversing recent cuts.

The losses led the group’s officials to reassure markets that it would change its mind even if circumstances dictated.

Keys around 02:30 GMT

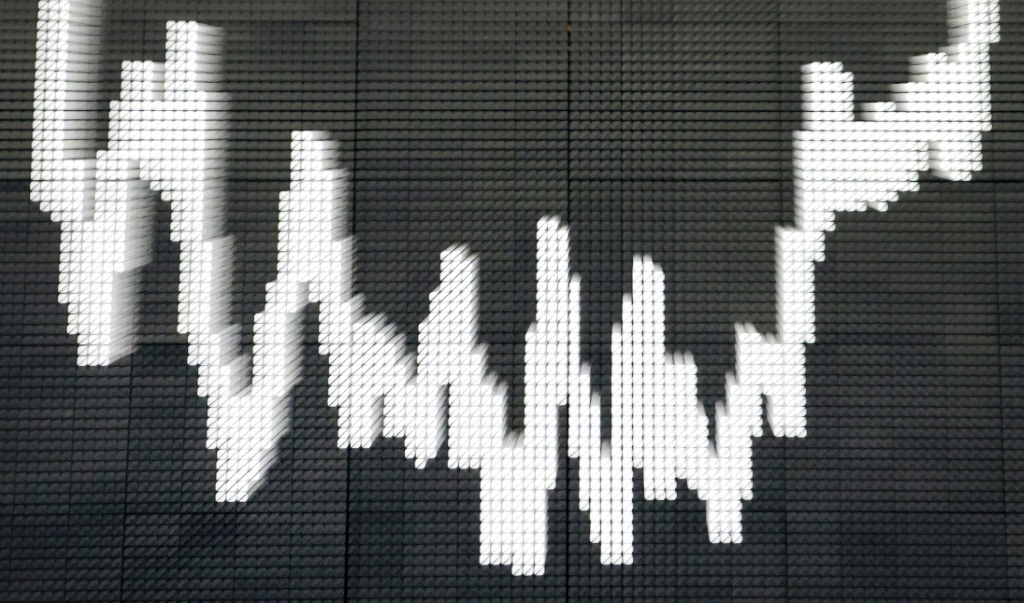

Tokyo – Nikkei 225: UP 0.3 percent at 39,155.16 (break)

Read also

Asian markets move as traders watch the important US jobs report

Hong Kong – Hang Seng Index: DOWN 1.8 percent to 18,033.65

Shanghai Composite: DOWN 1.2 percent at 3,014.87

EUR/USD: UP at $1.0768 from $1.0767 on Monday

Euro/pound: UP to 84.57 pence from 84.54 pence

Dollar/yen: UP to 157.22 yen from 157.04 yen

GBP/USD: DOWN to $1.2731 from $1.2732

West Texas Intermediate: DOWN 0.2% to $77.57 a barrel

North Sea Brent crude: DOWN 0.3% to $81.39 a barrel

New York – Dow Jones: UP 0.2 percent at 38,868.04 (close)

London – FTSE 100: Down 0.2% to 8,228.48 (close)

Source: AFP